Strategic Defaults in Bend Oregon

The photo above is simply a great photo; I used it because I love it . . . the raw power (and even the fear it evokes). It’s really not meant to be symbolic, or even a metaphor for anything. I guess if I were deeper (more glib?), it could represent the huge “wave” of strategic defaults (and subsequent foreclosures) presently challenging the real estate market in Bend Oregon. Truth is, I just like the picture.

Strategic Defaults

An interesting article by Carolyn Said in the San Francisco Chronicle a week or so back told the tragic tale of a young couple who bought a condo in Marin County in 2005, for $425,000, just prior to the husband’s deployment to Kuwait. Upon his return home, he was shocked to realize that the home was worth barely one half what he had paid. “I don’t want to keep on paying when the house will never go back up to its value. It’s better to get out of there . . . and rent.”

A similar scenario repeats itself daily in Central Oregon . . . the numbers now show that roughly 25% of defaults are voluntary or “strategic defaults.” And as more more and more “regular” folks are affected, it seems as though defaulting has lost some of its stigma. In an area like Bend Oregon, unemployment has been a huge problem, but many homeowners simply don’t want to be “saddled with a huge mortgage when they have no equity.”

Tipping Point . . . 25% Negative Equity

First American Core Logic (a company that analyzes mortgage data nationwide) states that a “tipping point” seems to occur when owners are faced with negative equity of 25% (owing $250,000 on a home worth $200,00). That issue becomes quite pronounced for folks who have bought homes in Bend or Central Oregon in the last couple of years. See some other interesting statistics in my recent post–Bend Oregon home price drop leads nation. “The reality is, if you are 30% underwater, you’re going to be in renter in that home . . . for 10-15 years before you get to break-even,” stated the director for the Center for Responsible Lending.

Shame, guilt, and fear . . . not

Some owners feel the above, but for others it’s more a matter of facing the reality of throwing “good money after bad.” Even the psychology of borrowers has begun to change . . . previously, the “hierarchy” payments had always placed the mortgage first; we’re starting to see folks who have kept up on credit card and car payments, but have let the mortgage slide. Enter the “strategic default.”

How many are strategic defaults in Bend Oregon?

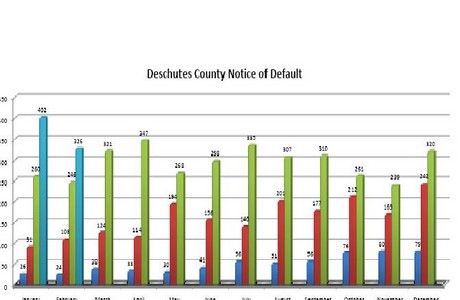

And with consistently high numbers of notices of default each month in Deschutes County,

and an unemployment rate of over 10.5%, we are going to see more strategic defaults in Bend Oregon . . . maybe that photo is pretty applicable.

The Bend lifestyle is still remarkable . . . search for homes in Bend Oregon.