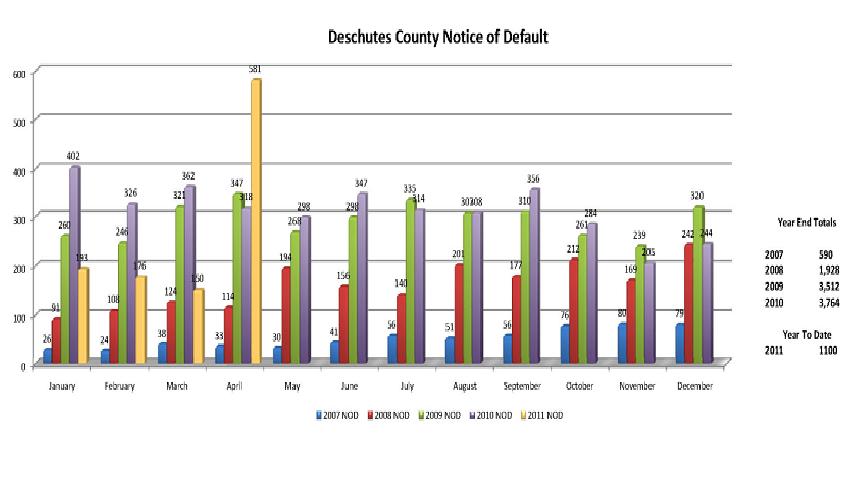

Deschutes County Notices of Default . . . April

Notices of Default in Deschutes County skyrocketed to an all-time high of 580 in April . . . that’s 180 more than the previous high month (January 2011). The photo above is a sardonic effort to symbolize the huge wave of NOD’s that overwhelmed us last month; it also hints that what happens next may not be good.

An Indicator?

April’s tsunami (figuratively speaking) is an indicator that foreclosures in Bend will once again surge–especially after it had appeared that things were slowing (Deschutes County Foreclosures Halted) as lenders paused to evaluate the robo-signing issue amongst others.

Bank of America . . . Recon Trust

More than 80% of April’s NOD’s were filed by Recon Trust, a subsidiary of Bank of America; a sign that the bank will restart foreclosure proceedings. A spokeswoman for Bank of America did not respond to a call for comment. How strange! I don’t think I’ve ever gotten a call back from Bank of America.

“ReconTrust conducts foreclosures at the direction of Bank of America”, said Jeff Sageser, recording supervisor at the Deschutes County Clerk’s Office.

“If you start peeling away the layers and looking at who’s at the root of it, it was ReconTrust,” Sageser said of the sharp decline and quick rebound in notices of default in Deschutes County.

Going Forward . . . Painful Medicine

The roller coaster ride will most likely continue

at least into 2012, thus ensuring a continued inventory of distressed properties (63% of last month’s sales were distressed). As Dave Woodland of Signet Mortgage (I don’t know who he is either!) said, ““There is no benefit in having large numbers of future foreclosures waiting to keep hitting us. It’s painful medicine, but the national economy is not going to recover until housing recovers, and housing can’t recover until we get through the foreclosure boom.”